You can pay for municipal services at the Municipal Office via the following options:

- Cash

- Cheques

- Post-dated cheques

- Interac

- Pre-Authorized Payment Plan

- Online through your bank

Please note that we do not accept credit card payment for property or water taxes.

After-hours payment

Payments with tax bill slips can also be dropped off after hours in the mail slot to the left-hand side of the main door, or sent by regular mail.

Paying through your bank

You may also pay your tax and water bills at your bank or through online banking. Each bank has a different account name and number format. Please refer to the table below. (Note: tax and water payments need to be setup as separate accounts for each property you own in Laurentian Valley).

Paying taxes online through you bank - set-up instructions

We encourage you to use the online payment options. Tax and water bills can be paid online through your online banking services.

To add the Township of Laurentian Valley as a payee, use the search-term “Laurentian Valley” and choose “Taxes” for property taxes. Your account/roll number can be found at the top left-hand side of your bill. Use this account number but do not include the decimal point or the numbers that follow, adding extra zeros to the end if required.

For water/utility billing, use the account number that appears on your utility bill. It will begin with 074,066 or 062.

Do not add spaces, dashes or decimals.

Please contact the Municipal Office at 613-735-6291 if you need assistance adding Laurentian Valley as a payee on online banking.

Reminder: There are two installments with each billing period.

How to read your tax bills

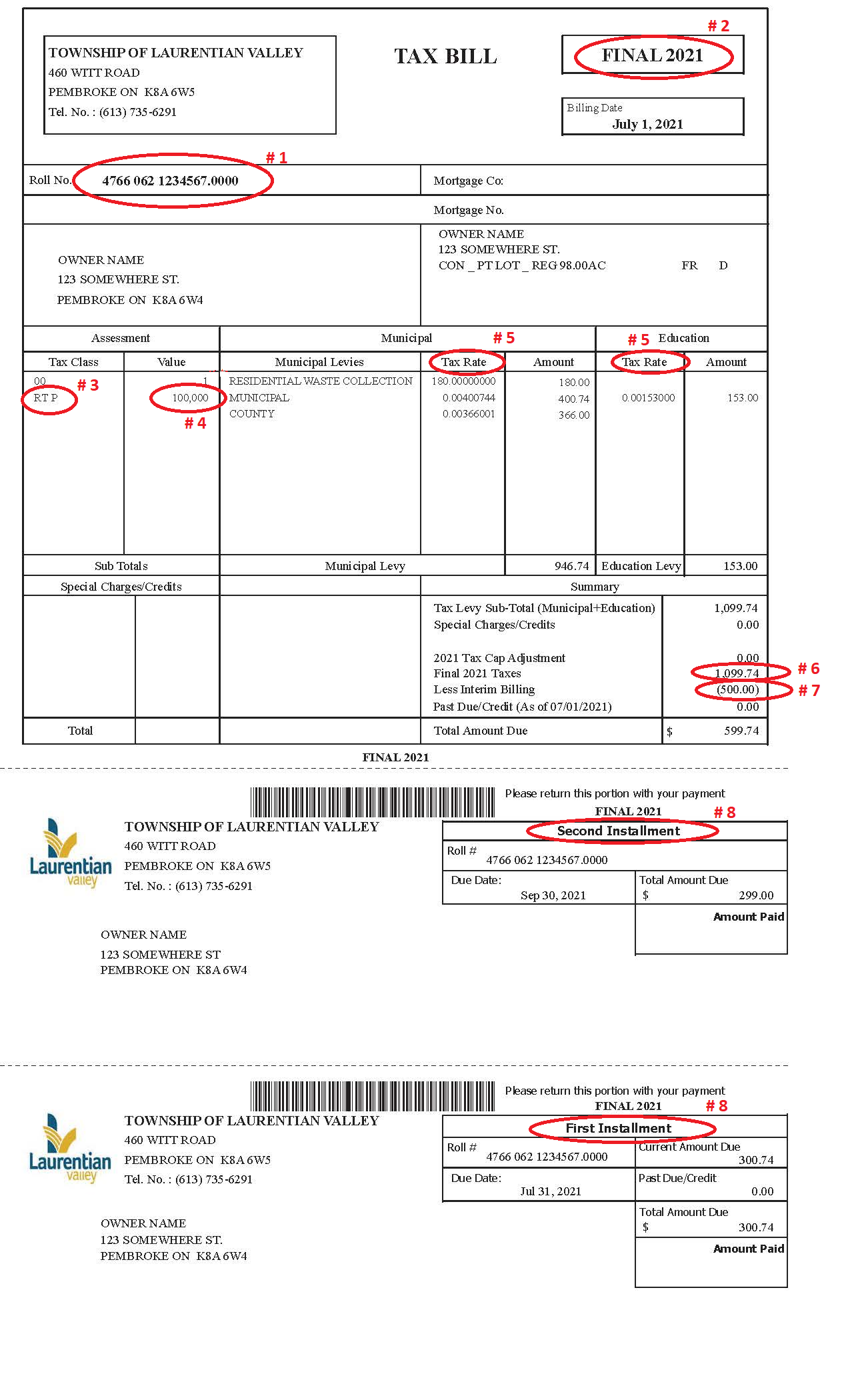

Reference the above sample property tax bill to learn more about each section. Each number below expands to provide an explanation to the corresponding number on the image.

Download a PDF version of the sample bill

|

#1: Roll Number |

|

Located on the upper left-hand side of property tax bills, this is your property identifier and property tax account number. |

|

#2: Billing Cycle |

|

Located in the upper right-hand corner of property tax bills, this states the period of the billing cycle.

|

|

#3: Tax Class |

|

Located below the property owners name and address, this indicates what tax class the property tax is calculated under. Each tax class has a different tax rate associated to it. The common tax classes are:

|

|

#4: Value |

|

Located next to the tax class, this is the assessed value placed on the property by MPAC. |

|

#5: Tax Rate |

|

Located in the mid-right portion of the tax bill, this is what the assessed value is multiplied by to calculate the taxes payable for the year. These rates are specified every year in the annual budget. |

|

#6: Final Taxes |

|

Found only on the final billing cycle tax bill in the lower right-hand corner, this is the total taxes that will be paid for the year and is the amount that is used when you file income tax return. |

|

#7: Less Interim Billing |

|

Found only on the final billing cycle tax bill in the lower right-hand corner, this is the amount that was billed on the interim billing for the year. |

|

#8: Installment |

|

Located at the bottom of the tax bills, these slips breakdown the amount payable into two installments and state when each installment is due. They are removable to be sent in with payments. |

Where urban amenities meet outdoor rural fun.

LV is home to easy comfortable living.

.png)